Updated on July 25, 2021

You’re in the market for a new – or perhaps a new-to-you – car. So, where do you start? You probably know the best deals go to educated buyers. And whether you’re purchasing your first car or are a seasoned buyer, there’s always something to learn.

To give you a competitive advantage on finding the best vehicle and facilitating an easy transaction, we’ve compiled a comprehensive guide that covers what you’ll need to know. From finding the best deal to negotiating a final price, these tips will help you improve your strategy. Informed consumers are smart consumers, so let’s start at the very beginning.

Do Your Research

Before you set foot in a dealership or do your first online search, you must narrow your focus and be clear on what, exactly, you’re looking for. You’ll probably already have a make and model in mind. Next, ask yourself these important questions.

How Much Car Can I Afford?

You know what your dream car is, but do you know if you can afford the price tag that comes with it? Any car you pick needs to fit within your budget. One easy way to determine the maximum amount you should spend on a car is by calculating 10% of your monthly income – that amount should be your maximum monthly car payment. Keep in mind that this number doesn’t include routine expenses like insurance, maintenance, and fuel. Although this percentage isn’t absolute, it gives you a solid idea of what you can expect to spend comfortably each month.

Use our free calculator to see how much car you can afford.

Should I Lease or Buy?

One decision you’ll need to make early on is whether it’s better to buy or lease a car. The differences between buying and leasing are significant. Let’s look at a few of them.

| Buying | Leasing | |

| Ownership | You own the vehicle and can keep it as long as you want. | You must return the vehicle at the end of the lease term, unless you make arrangements to purchase it. |

| Monthly Payments | You may pay for the car in full when you buy it. You might also take out a loan and make monthly payments. The loan payment is usually higher than a lease payment because your payments include the purchase price, taxes, and other fees. | Your monthly payment is based on the vehicle’s depreciation in value while you’re using it, plus any interest, taxes, and other fees. |

| Mileage | You can drive the car as many miles as you’d like. | Most leases cap the number of miles you can drive. You can exceed that amount, but you will likely have to pay per-mile charges for the miles in excess of the cap. |

| Future Value | Although the car depreciates in value over time, the depreciation will vary depending on the car’s condition. However, the more payments you make, the more equity you have in the car. | The car still depreciates, but the future value of the car has no effect on you. You also have no equity in the vehicle, so you have nothing to leverage. |

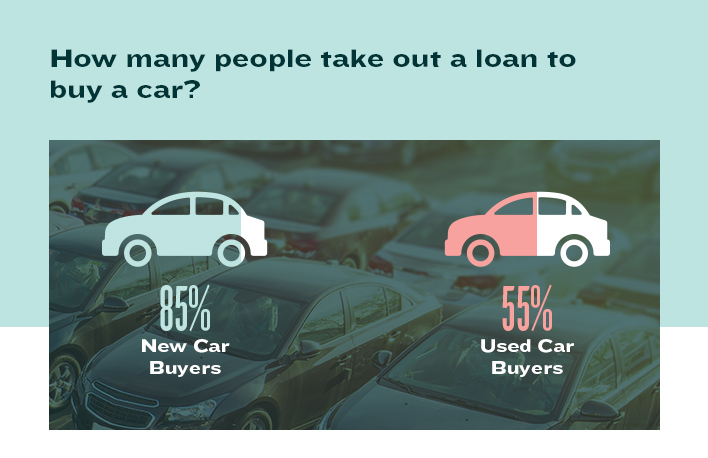

Should I Take Out a Car Loan?

According to research, If you’re thinking about taking out a loan for your car, consider the length of the loan. As your car gets older and its mileage increases, its value will go down. Taking out an auto loan longer than 50 months can result in your car’s value depreciating faster than you can pay down your principal loan balance. Longer loan terms can be tempting to get your monthly payment where you need it to be, but you’ll pay more in interest, and you may end up owing more than your car is worth.

If you opt for a loan, you may want to get a preapproval about two weeks prior to car shopping. This will give you an idea of how much you can afford and will potentially give you some room for negotiation at the dealership. And before you sign on the dotted line, make sure you’ve compared terms and rates among various financial institutions. Credit unions are a great place to look for a car loan and are often able to offer competitive rates.

You can get prequalified for an auto loan with PSECU quickly – usually within the same day you apply. Once you’re approved, we’ll mail you an AutoDraft, which is like a check written for a preapproved amount that you can use at any authorized dealership. You’ll complete a few pieces of information, like the repayment frequency and term. The dealer will take care of the rest. This will help avoid any last-minute surprises – like unexpected interest rate increases or being denied for financing – that may impact your ability to purchase a vehicle.

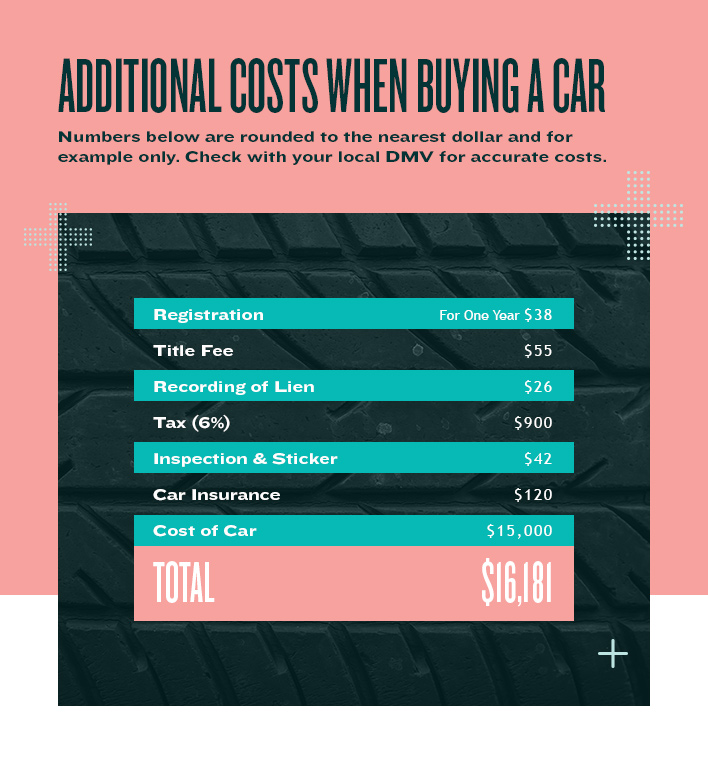

What Is the Total Cost of Purchasing a Vehicle?

In Pennsylvania, the purchase price of the car won’t be your only expense. You’ll also need to consider these fees:

- Registration (for a passenger vehicle): $38 per year

- Title fee: $55.00

- Recording of lien (if vehicle is financed): $26

- Tax: 6% of the purchase price of the current market value of the vehicle (7% for Allegheny County residents and 8% for City of Philadelphia residents)

- Annual inspection sticker: $8 per year (This doesn’t include the cost of the actual inspection.)

- Insurance: Before you can be issued a license plate, you’ll need to provide proof of auto insurance. Costs for insurance can vary widely; do your research before purchasing a policy.

Should I Buy a New or Used Car?

The answer is different for everyone. Answering these questions may help you determine whether buying a new or used vehicle makes the most sense for you:

- Can you afford the maintenance and repair expenses a used car incurs? Does a new car provide any warranty or additional coverage for the first few years?

- Can you afford the hidden cost of new car depreciation, which is the difference between the price you pay and the value of the vehicle when you later sell it or trade it in?

- Do you want your vehicle to have the latest technology and safety features? Are there used cars available that have these options?

- Do you have the extra money for the potentially higher down payment and cost of a new car?

- Do you want a flawless new car or are you OK with a vehicle that has a little bit of wear and tear?

- How will a new or used car impact the cost of your auto insurance?

Where Should You Look for Your Next Car?

If you’re looking for a new car, you’ll likely head straight to a dealership to make your pick, but if you’re in the market for a used car, you have more options available to you. Where you purchase a car may also have an impact on its cost.

- Private parties. With this option, you’re buying a car directly from an individual. You can find them in several places, from an online classified ad to someone’s front yard. Understand that most private party sales are “as is,” so be sure you have the vehicle inspected by a mechanic before you buy it. If there are any issues that the seller will cover, make sure you note this on the bill of sale.

- Used car retailers and dealerships. There are several pre-owned automotive groups throughout Pennsylvania, and many dealerships also have used cars available. Most of the used cars sold by dealerships have received an inspection and had any major issues repaired, making them less risky options. Some dealerships also offer “certified pre-owned” vehicles that come with a warranty because they’ve been inspected and certified to be in good condition.

- Independent dealerships. These dealerships aren’t associated with a specific manufacturer, so the selection may vary significantly here. Make sure you visit reputable dealers by reading reviews first, and run vehicle reports for any car you’re considering.

- Auctions. Auto auctions can be open to the public or private – which requires you to have a dealer license. While you might be able to find a good deal, some vehicles at an auction have been repossessed, in a flood, or are trade-ins that a dealership doesn’t want. A little later in this article, we’ll discuss more about what you should know before buying at an auto auction.

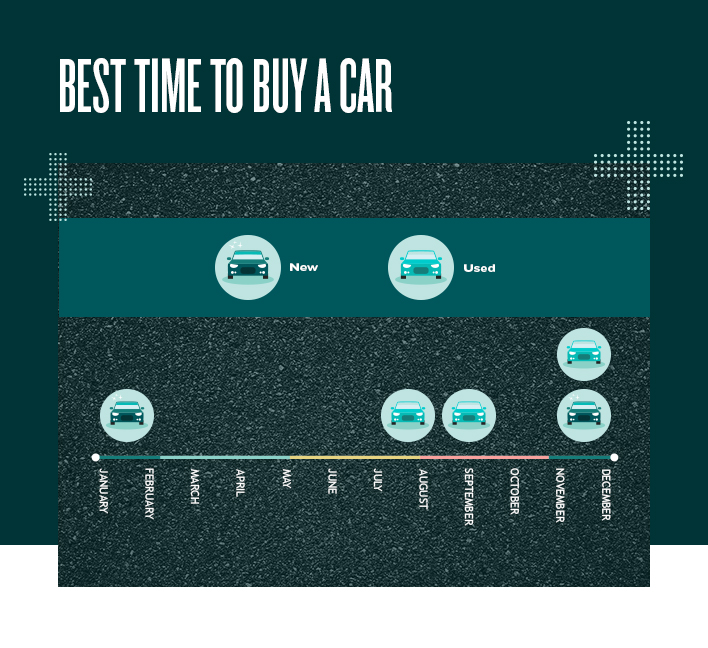

What’s the Best Time of the Year to Buy a New or Used Car?

Timing is everything when it comes to buying a car. The best time of year to buy can depend on whether you’re looking for a new or used car:

- New car. The end of the year – and the beginning of the year – is a great time to shop, as dealerships are clearing their lots to bring in new models. There may also be year-end incentives that’ll help dealerships meet their sales quotas.

- Used car. While the end of the year is also a good time to shop for a used car at a dealership, you might also find great deals in late summer or early fall.

Beyond thinking about the best time of the year to shop, also consider the best days of the week – and even time of day. Consider visiting the dealership toward the end of the month or the end of a quarter, when salespeople might be more motivated to make deals in order to meet sales quotas. Go early in the week when the influx of weekend shoppers has dissipated, and visit at the end of the day when salespeople are eager to close a deal and get home.

By simply adjusting the time of day, month, and year you go car shopping, you might be able to save several hundreds or thousands of dollars off the price of the car.

How to Buy a Used Car

If you’ve decided to go the used car route, you’ll need to think about where you want to buy your car. Used cars are available from private parties, dealers, and auctions. But no matter where you get your vehicle from, there are several things to look for to ensure you’re getting a good car and a good deal.

What to Know About Buying a Used Car

Buying a used car can be a nerve-wracking experience if you aren’t prepared. But while you’ve probably heard plenty of horror stories, there are just as many success stories. Do your research, and have a complete understanding of the car you’re looking at.

Here are some tips to keep in mind so that you don’t end up with a lemon:

- See the car in person. No matter how great the online deal seems or the amount of pressure the seller puts on you, don’t make a purchase until you’ve had a chance to drive the car and do your research.

- Visually inspect it. Are there dents? Signs of a new paint job? Evidence of leaks? Musty smell inside? If you’re not knowledgeable about cars, bring along someone who may pick out issues you miss.

- Take it for a test drive. How does it handle on a variety of roads? Are there any unusual sounds? Does the check engine light or any other warning lights illuminate when you turn on the car?

- Take it to a mechanic to have it inspected for any issues. Let them know you’re thinking about buying it and you’d like their feedback on the vehicle’s condition.

- Get a vehicle history report. It can provide valuable information about previous owners, significant accidents, and floods.

- Make sure you ask questions about how the vehicle has been maintained. Good owners will have a complete maintenance history to show you. Also, ask about any breakdowns, accidents, and other incidents that could’ve affected the vehicle.

How to Buy a Used Car From a Dealer

Buying a used car from a dealer often lends a little more confidence in your purchase, but it doesn’t mean you’re absolved of doing your due diligence. If you’re considering buying a dealer’s used car, make sure you:

- Can get a warranty. Most legitimate dealers should be willing to offer some type of warranty on the vehicle.

- Take it for a test drive. Never purchase a car – even from a reputable dealer – without driving it first.

- Negotiate the price. The sale price at a dealership is usually going to be higher than if you went through a private party. Although there’s less room for negotiation, the price may not be set in stone. Don’t be afraid to haggle. Not sure of what a vehicle is valued at? Many people use Kelley Blue Book® to check a used car’s value.

- Don’t get distracted by other deals. If you have your mind made up on a certain used car, don’t let sales pitches or other shiny cars distract you from the task at hand. Keep your goal – as well as your budget – firmly in mind when you go to the dealership.

Buying Cars at Auction

There are two types of auctions: government and public. How much cars will sell for at auctions varies widely, but cars at government auctions will often sell for much more than at public auctions, where the cars aren’t guaranteed to be as well-maintained.

Both are ways to get a great deal on a car, if you know what you’re doing. Buying a car at an auction comes with risks. You won’t be able to test drive or inspect the vehicle before purchasing, and you’ll also be competing with dealers who know all the tricks in the book. Typically, all vehicles are sold “as is,” so you won’t have any recourse if the vehicle isn’t what you expected. The risks of buying from an auction can quickly outweigh the potential savings.

Buying Used Cars From a Private Owner

Be wary of a vehicle you purchase from a private party. Many used cars sold via online classified ads are from curbstoners – those who repeatedly flip used cars for profit. Consider the following tips:

- Print out an inspection checklist and a repair estimate and take them – along with the car – to a reputable mechanic.

- Ask how long they’ve had the vehicle and why they’re selling it.

- Always get a written purchase agreement that documents the sale date, purchase price, and any warranties or promises.

- If you’re buying a car from someone online, copy the contact information and paste it in the search box to ensure they aren’t selling multiple cars – a sign they could be doing so illegally.

- Make sure the seller has the vehicle’s title and that the name and address on the car’s title matches that on the seller’s driver’s license.

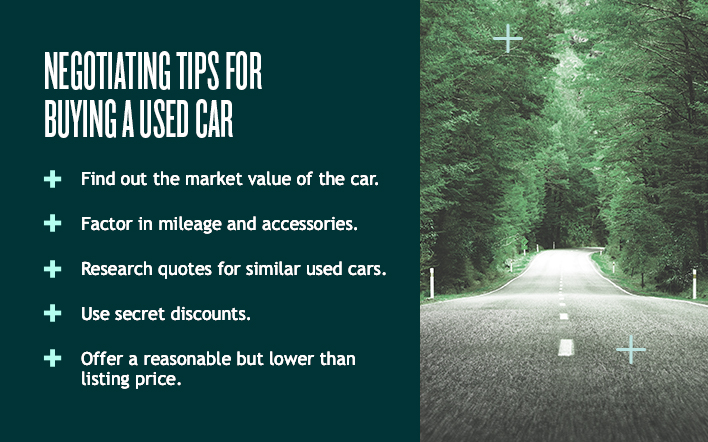

5 Negotiating Tips for Used Cars

After you’ve taken a look at a used car and decide you want it, it’s time to negotiate the price. To get the best price, follow these tips:

- Find out the market value of the car through Kelley Blue Book®.

- Consider the mileage on the car and its options. Add to, or subtract from, your price based on these features.

- Research used car quotes. Sites like com, TrueCar, Edmunds, and Cars.com let you search for a used car and get competitive quotes to help you negotiate.

- Take advantage of discounts. Some car quote sites, for example, may offer discounts if you initiate dealer contact through them.

- Make a reasonable (although lower than listing price) offer, and if they don’t accept, give them your number in case they change their mind and walk away. They may call you back afterward to accept.

How to Buy a New Car

Before you set foot in a dealership, get as much background information as you can on the car, the dealership, and any special offers that might be available. Most people go into a dealership knowing the car and the features they want. Walking into a dealership armed with confidence and information gives you a strategic advantage as you negotiate.

7 Steps For Buying a New Car

Just as you would with a used car, you should be prepared to do your research and understand what a fair price is for a new car. Before you sign on that dotted line, learn what you need to do to buy a new car:

| Ensure your financing is in order. Understanding how much you can afford and being preapproved for a loan will go a long way in making the purchase process a seamless one. | |

| Compare interest rates before the dealer makes you an offer. Dealers often increase your interest rates several points over the rate for which you qualify. That’s why it might be better to get your loan directly from a financial institution like PSECU instead of the dealer. | |

| If you plan to pay with cash or check, make sure you have the money in your checking account. | |

| Do your online research. Are there any special financing rates online from your manufacturer, or are there other special incentives that you qualify for? | |

| See the car in person first, and take it for a test drive. Even when buying a new car, this is important. Does it handle the way you expect? Does it have all the bells and whistles you want and need? | |

| While shopping around for the right car, take detailed notes about the pros and cons of each car. Take pictures with your cellphone so you can remember the visual details of each. Make sure the car you want is available locally. | |

| If you have a trade-in, make sure you know the value of your current car. Dealers won’t always give their best offer at first, so it’s important to be knowledgeable. If you think they aren’t giving you what you deserve, don’t be afraid to walk away and go to a different dealer. |

How to Get the Best Car Price

Once you determine the kind of car you want, research pricing for cars online. Take note of the price range of the vehicles. You can also request online quotes from local dealers. Review a car’s True Market Value (TMV®), which gives you the pricing of a new car, the invoice price of the car, and the manufacturer’s suggested retail price. It also lets you see what other people in your area paid for the same car.

Keep in mind the prices you see online at dealerships might not reflect the total cost of the car. Dealerships may advertise vehicles at a lower price to get customers to the lot. Before taking the time to drive to the dealership, call to confirm the true cost of the vehicle you’re interested in.

If you don’t feel confident negotiating with a salesman, consider bringing a family member or friend along you trust who has strong negotiation skills.

Don’t be shy about negotiating. Use the competitors’ quotes you’ve received to bring down the price. Before you begin the negotiation, ask to see the official vehicle invoice. Often, salespeople will combine several transactions into one, such as the down payment, trade-in value, monthly payments, and total cost of the car. However, you may be able to get a better deal if you negotiate each transaction separately.

After you feel prepared to negotiate the new car price, don’t hesitate to ask for extra perks – like free oil changes, inspections, or car washes. This is where that official vehicle invoice comes in handy. Look for line items not listed on the invoice that you originally wanted. You can also negotiate the prices of the “add on” products the dealership offers, such as extended warranties and paint protection. You’ll also want to look out for dealer prep fees or additional dealer markup fees and request they be removed before you end your negotiations. A word to the wise: Be absolutely sure about the car and the terms you’re buying it for. Unlike some other states, Pennsylvania does not have a “cooling off” period for buying a car.

Before You Drive Away

If you bought a new car, it should be clean and the gas tank should be full. Make sure that no dents, scratches, or other damages have appeared from the time you last saw the car. If you find damage that you don’t remember, pull up the photos you took of the car when first shopping around. In some instances, you may not get the same car you test drove. An example of this is if you wanted a specific color that the dealership didn’t have on the lot and had to do a trade for. Make sure you have the chance to check it over, and make sure it’s comparable to the one you originally saw.

Before you leave, the salesperson should give you a tour of the car and show you its features. Come prepared to ask any remaining questions you have about the car’s functionality.

Ready to Make a Decision?

Now that you have a better understanding of how to buy a car, it’s time to get started.

We want to help make the car buying and leasing process as simple and stress-free as possible. Check out our auto loans to see the competitive rates we offer members. Whether you’re buying new or used, we offer the same low rates. With an AutoDraft, you’ll have a check to take in hand when you go to any authorized car dealer. They’ll take care of the rest. Apply online, and you’ll get an answer usually within the same day you apply.

Kelley Blue Book® is a registered trademark of the Kelley Blue Book Co., Inc.

The content provided in this publication is for informational purposes only. Nothing stated is to be construed as financial or legal advice. Some products not offered by PSECU. PSECU does not endorse any third parties, including, but not limited to, referenced individuals, companies, organizations, products, blogs, or websites. PSECU does not warrant any advice provided by third parties. PSECU does not guarantee the accuracy or completeness of the information provided by third parties. PSECU recommends that you seek the advice of a qualified financial, tax, legal, or other professional if you have questions.